future of rpa in finance

Making RPA easier to deploy. Explore how 2020 impacted the future of finance and why automation and RPA initiatives are crucial for organizations going forward.

Pin By Amani Mash On 2020 Future Technology In 2021 Innovation Strategy Banking Finance

2020 revealed many weaknesses and shortcomings in tools used by the Office of Finance which prompted.

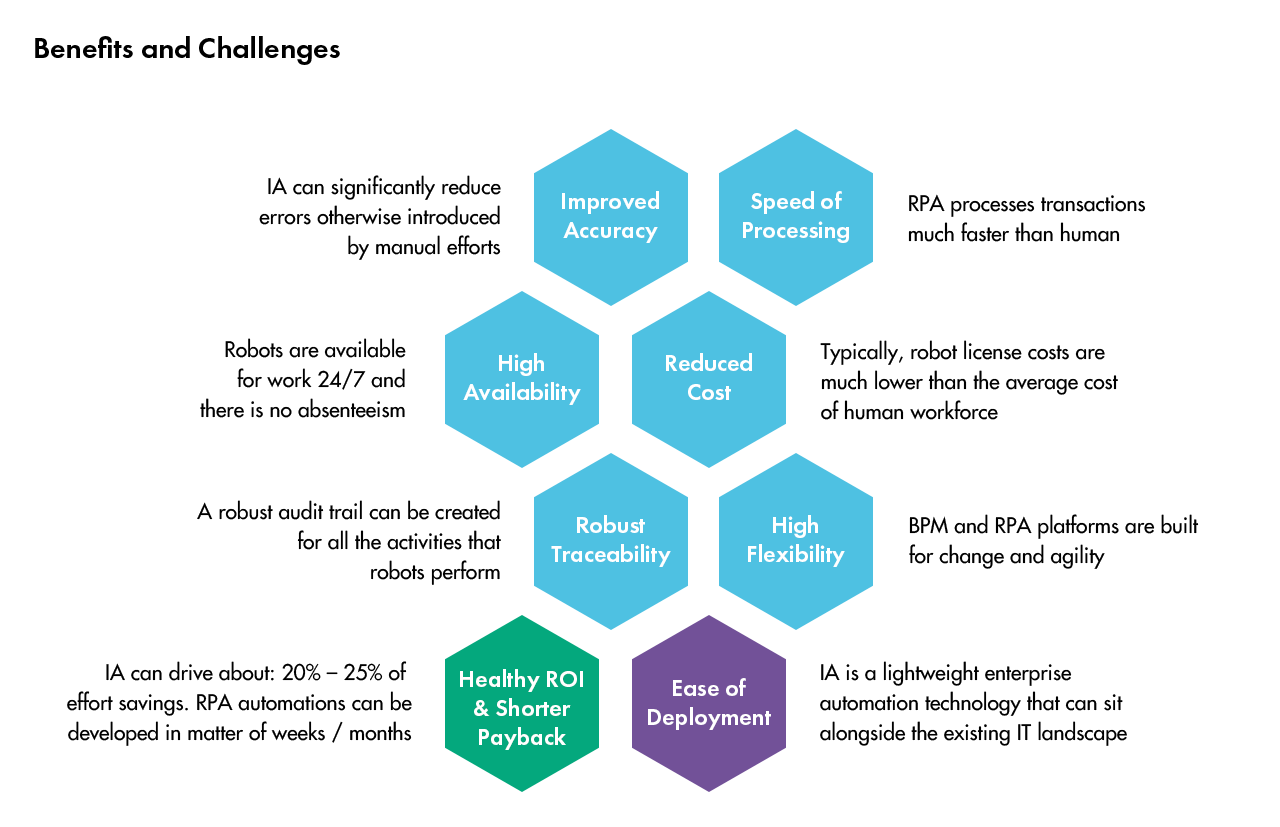

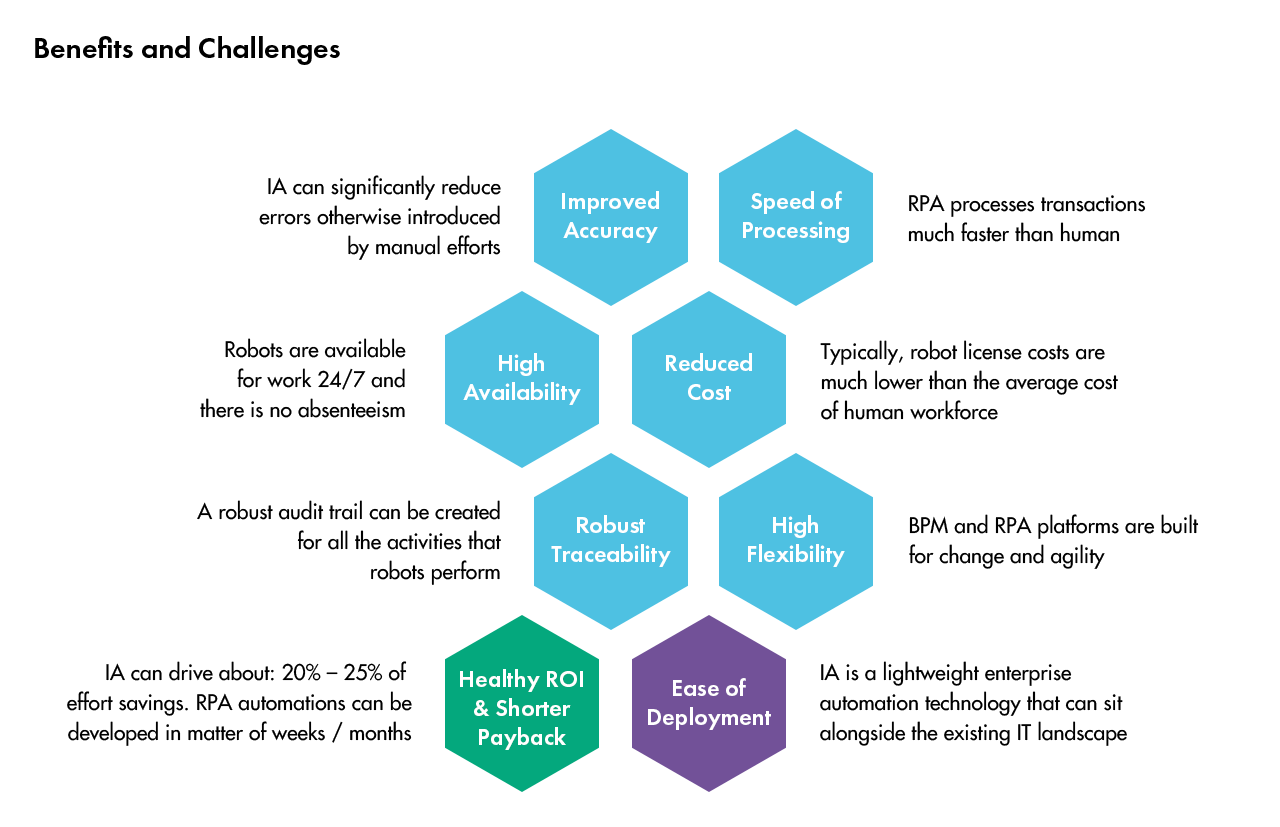

. Despite the benefits of RPA and AI accounting and finance still lag when it comes to automation with only 12 of surveyed companies utilizing RPA tools. What does RPA involve. What is the future of RPA in finance.

Therefore when market conditions or regulatory reporting eg. RPA implementations begin in the finance and accounting department. Success requires every RPA leader to consider where and when to apply analytics automation and artificial intelligence AI in their design.

Henry Scanlan June 22 2020 4 min read. The future of RPA in banking is only going to continue to grow as organisations realise financial transformation. RPA has been found to improve efficiency in performing finance and accounting operations.

Leading solution providers are working to simplifyfacilitate the most labor expensive portions of RPA deployment which are design development and maintenance. These uses can translate into cost savings improved employee morale and better productivity. A digital assistant for every member of the finance team According to Gartner 4.

Around 80 of finance leaders have implemented or are planning to implement RPA In a move to improve workforce efficiency CFOs are looking. Using RPA in banking financial and related sectors has helped reduce overhead and operation costs and dramatically decreased workload which in turn has increased the efficiency of the employees. Due to the unforeseen events that occurred during 2020 and the industry-wide switch to work from home RPA technology.

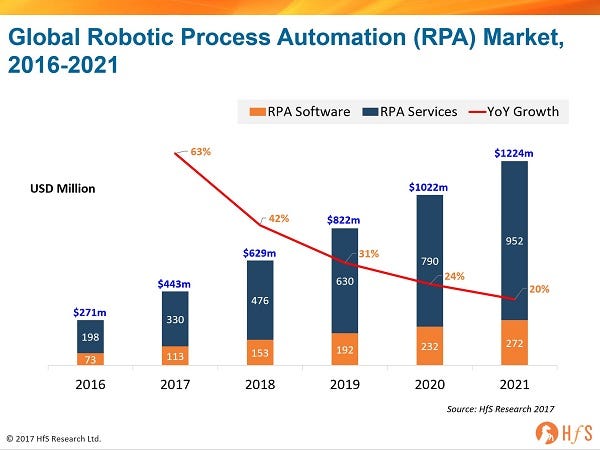

About a third of the opportunity in finance can be captured using basic task-automation technologies such as robotic process automation RPA. Since those processes are so vital to a company its important to get off to the right start. According to the Gartner analysis the industry is expected to spend 2 billion on RPA in 2021 and the companies that have already embraced RPA are now seeing a higher business performance with most of their operations streamlined processes automatically updated and more effective communication within their digital infrastructure.

Time-consuming and lengthy tasks can now be performed within a very short period. We see 3 trends shaping the future of RPA. Many companies have invested in Robotic Process Automation RPA to stay competitive in their industry and theyve noticed massive returns on their investment with this technology.

Automation adoption is set to accelerate in coming months but businesses will repeat the same mistakes of recent years if they go for quick-fix solutions without firm use cases. Moreover robotic automation helps to keep data between multiple sources in sync while also minimizing error. Do more with the same number of employees Expand the customer base and add new services Reduce operational costs Better regulatory compliance Free employees to focus on higher value work RPA finance use cases and benefits.

RPA automates finance processes. I believe that being mesmerised by the hype around the shiny new things RPA AI cognitive-this predictive-that is distracting from some key issues that are more important. But it may also seem like a mirage in a world of continuous change and new technological landscapes.

Repetitive simple tasks are a small part of current white collar work. End-to-end integration is the future of RPA in finance. The future of RPA requires improved signal intelligence dynamic feedback loops and richer contextual relevance.

Having a future-ready finance function that leverages advanced technologies like robotic process automation RPA may elevate the role of finance professionals. Future Of Work. RPA is a complex constantly evolving technology but it doesnt have to be intimidating.

Start your finance organization on their RPA journey Automating finance and accounting processes can help ensure efficient accurate and timely results. According to Deloittes Global RPA Survey 78 of businesses that have already implemented RPA will continue to. At the same time finance robotics must be scaled out of shared services and into other finance subfunctions such as procurement and tax.

Navigating this new reality is refocusing finances roles and responsibilities. With new tools and an increasing commercial awareness of the value of automation new RPA use cases in finance and accounting have developed over recent years. Working atop existing IT systems RPA is a class of general-purpose software often referred to as software roboticsnot to be confused with physical robots.

In a future article I want to look at what this all means for Finance and the accountancy profession in general. As RPA is an emerging technology with one of the lowest barriers to entry the impact of RPA on the finance and accounting function is twofold. Internal control over financial reporting ICFR requirements change businesses may face a.

Finance is under pressure to increase the ROI on finance robotics sometimes called robotic process automation or RPA smart automation or intelligent automation. The brands and organizations that can improve decision velocity will succeed in anticipating customer needs delivering on. The Future of Finance Automation in 2022.

Nowhere is the potential of these gains more exciting than in RPA finance use cases. RPA Strategic In The Future Of Bank Finance Published 5 months ago on August 25 2021 By Salman Ahmad Table of Contents Quick Navigation The adoption of RPA robotic process automation in banking sector solutions today represents a strategic potential for companies in every sector to benefit the business. Maintenance of RPA bots can be difficult since the people who developed them may no longer be working on the project and the code base may be hard to understand.

Accounting robots can significantly reduce the repetitive tasks in managing accounts payable tax accounting financial close and more. Finance and accounting processes will be automated with RPA and finance and accounting professionals can upskill with RPA.

Rpa In Finance Benefits Use Cases Solutions And Examples

8 Real World Use Cases For Robotic Process Automation In Finance By Cigen Rpa Medium

Rpa Strategic In The Future Of Bank Finance Business

6 Forces Shaping The Future Of The Finance Function Pwc Via Mikequindazzi Rpa Bigdata Dataanalytics Automation Cfo Digitaltransformation Infogra

3 Emergingtechnologies And Ready To Impact The Cfo Function Mikequindazzi Hashtags Rpa Robotic Process A Finance Function Emerging Technology Technology

Why You Should Go For Rpa Rpa Robotics Automatiom Digital Enterprise Robotic Automation Deep Learning

Robotic Process Automation For Finance Ten Proven Use Cases

6 Use Cases Of Robotic Process Automation Rpa In Accounting Security Solutions Use Case Solutions

0 Response to "future of rpa in finance"

Post a Comment